The HomeNet Homeownership Center is a “one-stop shop” to help you achieve homeownership. Our mission is to prepare you for the home buying process through education and access to resources.

Services

- Grant source identification

- Comprehensive credit counseling, credit clinic workshops and credit repair

- Individualized action plan to overcome homeownership obstacles

- Assistance with obtaining a mortgage pre-approval letter

- Financial literacy including developing a healthy budget

- Pre-purchase homebuyer counseling

- Virginia Housing–approved first-time homebuyer education classes

- Post-purchase homebuyer counseling

- Access to qualified lenders, Realtors and attorneys

Available Programs

HOME Program

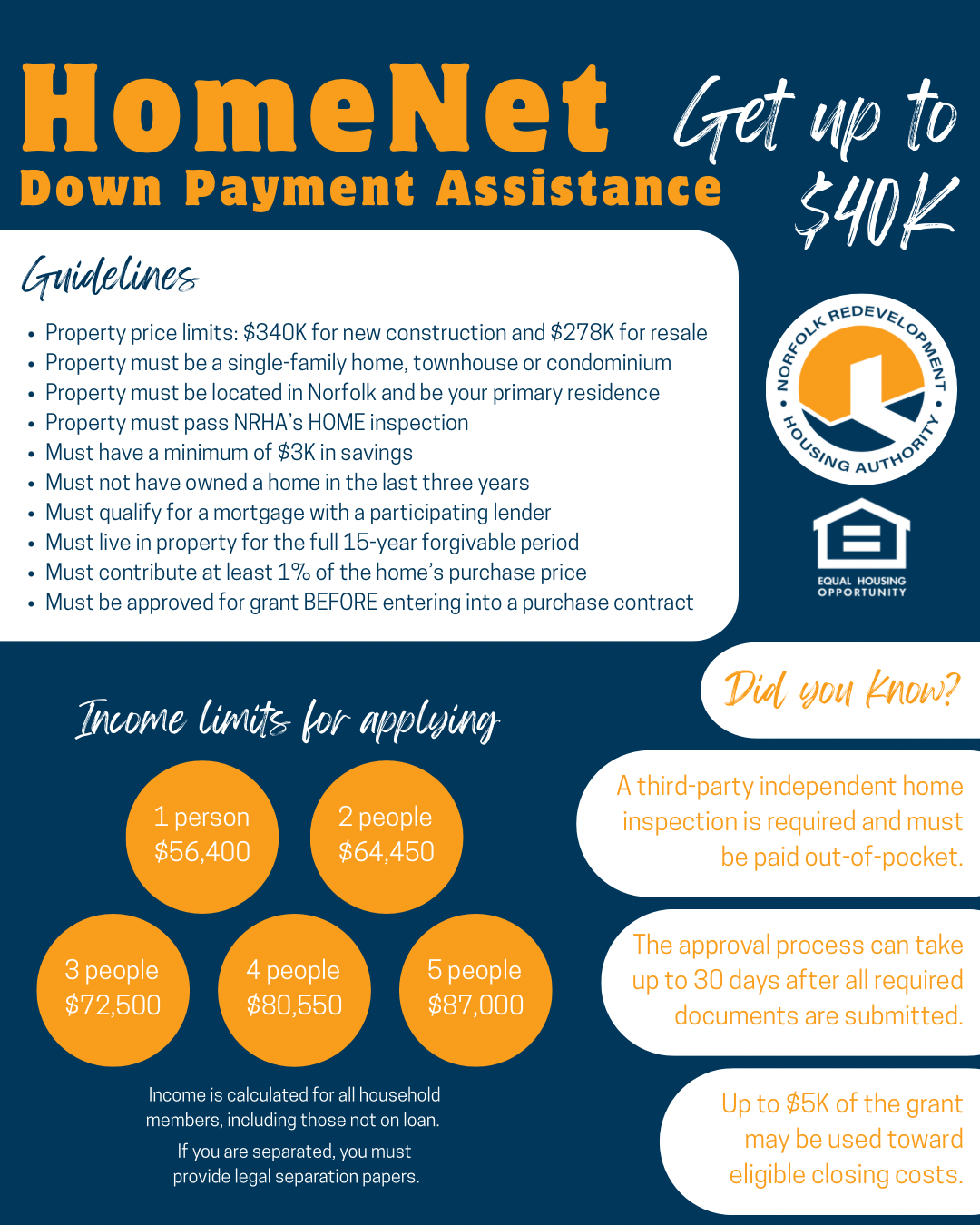

The HOME Investment Partnership Program, known as HOME, was implemented to by City of Norfolk and NRHA to expand the supply of decent affordable housing to low-to-moderate income households who choose to purchase a home in Norfolk. This program provides up to $40,000 in down payment and closing cost assistance to first-time homebuyers with household incomes at or below 80 percent AMI who are purchasing a home in Norfolk.

Homeward Norfolk Program

This program provides up to $40,000 in down payment and closing cost assistance to first-time homebuyers with household incomes between 80 and 120 percent AMI who are purchasing a home in one of three neighborhoods in Norfolk: Ingleside, Monticello Village or Oakdale Farms.

Virginia Individual Development Accounts (VIDA)

VIDA is a financial education and matched savings program available for working families purchasing their first home. Participants receive access to financial counselors, homebuyer education and the opportunity to earn money toward a down payment and closing costs. Here’s how it works: VIDA matches $2 for every $1 you save in a VIDA account. Matching funds are limited to $4,000 per participant with a maximum of two participants per household.

Homebuyers Club

This 16-month program provides education on the home buying process to prepare future homeowners for the transition from renting to owning a home. Session topics include pre-qualifying for a mortgage, understanding loans and grants, avoiding predatory lending, going through home inspections, understanding homeowners insurance, managing utility and maintenance costs, preventing foreclosure, protecting your investment, keeping your mortgage current in case of unemployment, and much more.

Sponsoring Partnerships and Revitalizing Communities (SPARC)

Through Virginia Housing’s mortgage interest rate reduction program, SPARC, eligible first-time homebuyers can receive a 1% mortgage interest rate reduction on a 30-year fixed loan. The rate reduction increases the homebuyers purchasing power and may save them thousands of dollars over the life of the loan. This assistance is available only for eligible buyers who are receiving down payment and closing costs assistance through the HomeNet Homeownership Center.

Ask Your Questions